Healthcare investment spend by venture capitalists is often seen as an indicator of where current and future technology needs may be present within healthcare. These needs can be driven by factors including patient needs/expectations, societal changes, technological advances and others. As we begin to emerge from COVID-19 as an industry, it is no surprise that we are seeing more investment in areas like behavioral health, remote patient monitoring (RPM), telehealth, cybersecurity, virtual fitness and others.

Healthcare investment spend by venture capitalists is often seen as an indicator of where current and future technology needs may be present within healthcare. These needs can be driven by factors including patient needs/expectations, societal changes, technological advances and others. As we begin to emerge from COVID-19 as an industry, it is no surprise that we are seeing more investment in areas like behavioral health, remote patient monitoring (RPM), telehealth, cybersecurity, virtual fitness and others.

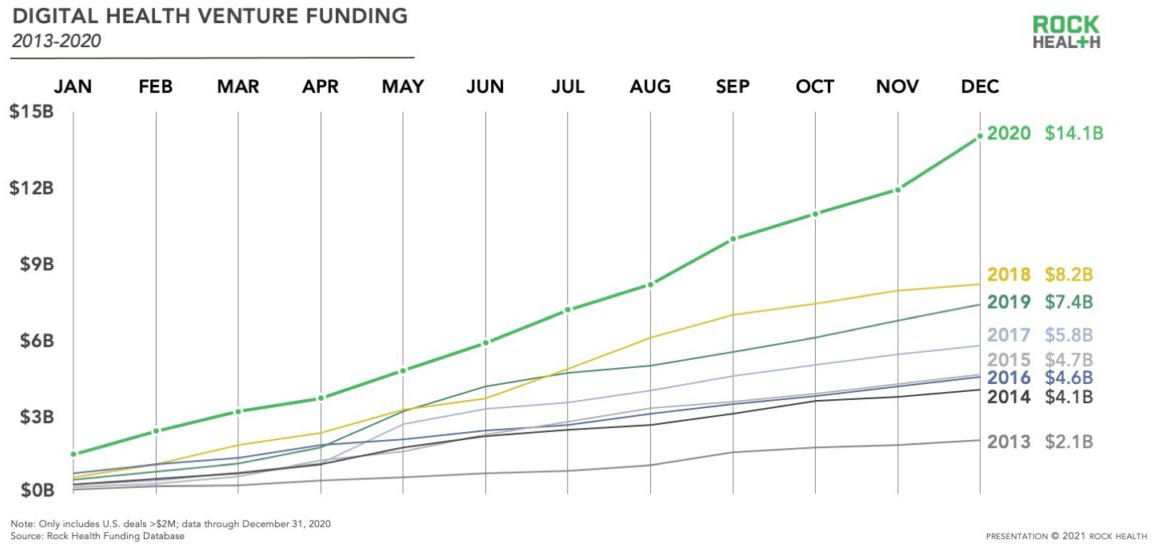

According to Rock Health’s Market Insights Report, venture capital dollars flowed to U.S. digital health companies at a new all-time high, with over $14 billion invested across 440 deals. This influx in capital as well as the rising voice of the consumer has left our current healthcare ecosystem ripe for innovation and new ideas.

Source: Rock Health

With this, several investors shared their insights on what trends they are seeing in the marketplace and a look ahead on what to expect in healthcare investing.

Pothik Chatterjee, Executive Director, Innovation & Research, LifeBridge Health; Emily Durfee, Manager, 1501 Health Innovation and Jordan Evans, Manager, 1501 Health Innovation; HIMSS Collaborators

Pothik Chatterjee, Executive Director, Innovation & Research, LifeBridge Health; Emily Durfee, Manager, 1501 Health Innovation and Jordan Evans, Manager, 1501 Health Innovation; HIMSS Collaborators

The Top Three Trends in Healthcare Investing

1. Telehealth 2.0

Due to the impact of COVID-19, 30% of all visits during the pandemic were provided by telemedicine. Investments are being driven by high utilization, changes in reimbursement policy from both government and private payers, and remote patient monitoring opportunities. Telehealth can drive efficiency and improve cost, while also allowing expanded access to care and reduced patient demand on facilities. Preventative population health management leveraging telemedicine also helps reduce avoidable readmissions to the emergency department—by engaging patients more frequently at a lower cost. Despite the growing demand for more of these solutions, we’ve learned that certain care plans don’t benefit as much from telehealth as others. The next challenge is figuring out truly blended care, including seamless triage and referrals between remote and in-person care to help improve the overall care journey.

2. Consumerization of Digital Health

Consumers will continue to demand three key things in healthcare—access, price and outcomes. As part of access, consumers expect patient experience in healthcare that is on par with tech, retail and financial industries. Patients expect a seamless digital experience as they navigate scheduling, medication orders and follow-up communication. To create this experience, we need data seamlessly integrated between electronic medical records and technology platforms to support the patient journey. At the same time, the question remains—how do we combine customer experience lessons from tech leaders with effective healthcare delivery?

3. Health Equity and Community-Centric Innovation

The pandemic and the response in the United States exposed fault lines within the healthcare industry when it comes to underserved populations. Digital health companies are starting to address previously unmet needs for underserved populations as social consciousness shifts. Examples of unique companies in the social determinants of health space include socially determined (mapping social determinants of health needs, cost and utilization at a granular level), eMocha (inhaler and medication monitoring for pediatric asthma patients in Baltimore) and LiveChair (leveraging the barbershop setting to engage Black men around their healthcare, particularly chronic conditions like hypertension and diabetes). Looking ahead, it will be interesting to see how future solutions add risk-sharing models to align outcomes, especially related to Medicare and Medicaid populations.

How Healthcare Investing Trends will Impact the Market in the Next Year

Telehealth: We should expect to see add-ons to telemedicine platforms like pairing with clinical decision support for providers, use of AI (such as chatbots and triage tools), and platform pairing with remote patient monitoring devices. We’re also expecting to see reimbursement policy changes—anticipating Medicare to more permanently expand telehealth coverage. Private payers have also begun to reimburse for remote patient monitoring for chronic disease such as congestive heart failure, COPD and diabetes. As remote patient monitoring matures, patient-generated data will get better integrated into clinicians’ workflows.

Consumerization of Digital Health: We anticipate increased utilization of patient engagement tools due to COVID-19 and changing reimbursement policies for RPM from Medicare and payers. At Sinai Hospital in Baltimore, for instance, employees are using GetWell Loop, a patient engagement and communication platform, to monitor vaccination symptoms and COVID-19 symptoms prior to arriving on campus. As patient-facing apps and tools proliferate, we expect more healthcare systems will start developing “digital front doors” that help patients navigate the care continuum digitally. Beyond the digital front door, we can also expect more forward-facing solutions, like health concierge services and more patient-friendly provider directories. It will be interesting to see how best practices from other industries make their way into healthcare.

Community-centric innovation and health equity: Moving forward, we’re anticipating a sustained increase in valuations of startups focused on underserved populations. Access to care and health equity will continue to be a priority in healthcare and funding in the future should reflect that. We can expect a rise in the number of startups in the space and we might see growing markets in social entrepreneurship and impact investing. This is also a space ripe for public-private partnerships and joint ventures between interdisciplinary players to generate stronger and more sustainable impact together.

The Impact of COVID-19 on Healthcare Funding and the Lessons Learned

The pandemic has increased demand in a dramatic way for digital health solutions, especially as it relates to access to care. According to Rock Health, funding for digital health startups nearly doubled from $7.5 billion in 2019 to $14.1 billion in 2020. Moreover, StartUp Health reported that health innovation funding increased 55% from 2019 to 2020.

Massive increases in the funding of virtual care and telemedicine were somewhat predictable, but it revealed more nuanced trends. With millions confined to their homes and isolated from social channels, a stronger demand for behavioral health intervention surfaced. As the pandemic continues, mental health challenges will continue to grow more complex and require greater sophistication from digital health platforms in the wellness space.

We’re not expecting to see overall funding or the number of deals to suddenly regress back to prepandemic times. This past year has made it clear that patients/customers want more tech-enabled healthcare services in the palm of their hands and at home. The challenge for providers moving forward, however, is to implement these services while improving experience and quality over time. This is precisely why provider partnerships with tech startups and payers are so essential to navigating this next wave of transformation.

Matty Francis, Principal, Strategic Investing, Healthbox, a HIMSS Innovation Company

Matty Francis, Principal, Strategic Investing, Healthbox, a HIMSS Innovation Company

The Top Three Trends in Healthcare Investing

1. Infrastructure 2.0

To date, the primary infrastructure platform for healthcare is the EHR; virtually everything flows through an EHR at some point. However, we should expect additional infrastructure platforms and protocols to emerge this year. These infrastructure platforms likely will encompass core functions ranging from scheduling to billing, to dozens of other use cases. The next generation of digital health companies won’t build their own scheduling or billing functions, but rather leverage the off-the-shelf components that solve those pain points. By narrowing the set of product features to be built, new companies can focus on solving deep healthcare problems and not waste energy rebuilding tools that already function well. Hopefully this will make it easier to launch new health IT products.

2. Diagnostics Become Actionable

There have been some wonderful advancements in diagnostics, including the ability to detect disease earlier and with increased accuracy. We’re now at the point where in order to create additional value, that early knowledge of a disease or change in health status needs to automatically trigger the next appropriate action. If I need a recent negative COVID-19 result or proof of vaccination to board a flight or send my child to school, how can I effectively get that information to the appropriate third parties?

3. Patient and Physician Experience Become Table Stakes

One to two years ago, physician experience (PX) was almost considered a stand-alone category within digital health. Companies would even pitch themselves as patient or physician experience companies. Experience is closely linked to outcomes, so companies gaining traction are solving bigger health challenges and embedding experience into the core of their product, rather than selling experience alone. More bluntly, companies that don’t weave PX into the fabric of their platforms will likely struggle to win.

How Healthcare Investing Trends will Impact the Market in the Next Year

Total funding for digital health in 2020 hit all-time highs of $26.5 billion and when you add in the recent surge of exits, I wouldn’t be surprised to see 2021 achieve another all-time record. COVID-19 has made it readily apparent that healthcare isn’t a siloed, vertical industry, but rather a horizontal concern that intersects every part of life. Healthcare is currently affecting work, schools and leisure/entertainment activities. Executives and leaders across companies of all sizes, who previously may have only focused on employee wellness during open enrollment, are now realizing that the health of their employees is vital. When combined with it becoming easier to launch healthcare solutions, I expect to see the number of deals, as well as total invested capital to set records.

The Impact of COVID-19 on Healthcare Funding and the Lessons Learned

COVID-19 has injected a strong sense of urgency across the healthcare ecosystem, leading to dramatic change in a short period of time. I think COVID-19 laid bare that healthcare organizations are slow to move, not because they lacked the capability to move quickly, but rather because there was never a sufficient incentive or catalyst to move quickly. Organizations that were slowly adopting telemedicine saw their share of telemedicine appointments soar overnight. Were there some hiccups along the way? Sure, but one of the most important learnings is that even the largest healthcare organizations can move quickly when promoted to do so.

Bob Kocher, Partner, Venrock and Bryan Roberts, Partner, Venrock; HIMSS Collaborators

The Top Three Trends in Healthcare Investing

1. Telehealth

The first and biggest trend we’re seeing is the rise in telehealth. During the pandemic, many Americans experienced a virtual healthcare visit for the first time ever, and found the process to be faster, easier and as effective as in-person care. We believe that Medicare will make permanent telemedicine coverage that was enacted as a result of the COVID-19 public health emergency, leading many seniors to embrace virtual visits for a majority of their care. Virtual visits offer some clinical advantages. Clinicians can check in with patients more frequently, track biomarkers remotely and continuously, and intervene faster when problems arise—leading to better outcomes and reduced costs. It will be tough for brick and mortar healthcare businesses to replicate these features, since they have strong incentives for keeping the in-person status quo to cover their large overhead costs.

2. Mental Health Services

Next we’re seeing increased demand for mental health services of all types. In the United States, 50 million people suffer from mental health issues, and that number is growing rapidly due to the demands of the ongoing pandemic, recession and social unrest. As investors in Lyra Health, which enables companies to provide mental health resources to their employees, we think greater access to behavioral healthcare and tech-enabled care for more complex mental health needs is a huge opportunity. Increased access and usage of mental health resources will result in lower employee turnover and overall lower medical care costs.

3. AI for Healthcare

Lastly, we think that AI for healthcare will move out of buzzword territory and into useful products. Companies like Suki and Virta Health are making it easier for physicians to work more efficiently thanks to AI. In Suki’s case, doctors rely on a voice user interface to record notes, enter orders and exchange information with other providers—tasks that typically take valuable time and energy away from patient care. In Virta’s case, diabetes coaches use AI to predict how a patient is trending on their hemoglobin A1c values and to suggest personalized changes to their diets. Large opportunities exist to apply AI to reduce administrative costs, reduce medical errors, and incorporate genetic data into clinical care.

How Healthcare Investing Trends will Impact the Market in the Next Year

We think that it will be another busy year for health IT financings, M&As [mergers and acquisitions], special purpose acquisition companies, and IPOs. This will be fueled by the Teledoc/Livongo merger, success of 2020’s IPO class, and interest from large growth investors to invest in health IT. This will add pressure for health IT companies to grow even faster in this environment so they can potentially go public sooner or be acquired while multiples are high. We think M&A will be common among the many point solutions since merging with larger platforms makes it easier for the point solutions to acquire patients and the large platforms to demonstrate clinical value for their customers.

We also think that there will continue to be many promising companies created, particularly in virtual care, mental health, and primary care for Medicare and Medicaid populations. These are sectors where we think economic incentives and tech-enablement plus data are well aligned for new entrants to succeed.

The Impact of COVID-19 on Healthcare Funding and the Lessons Learned

There was a jump in health IT deals last year and funding in this space continues to break records. We think that this growth will continue to be driven by businesses and business-models that are created with better-aligned economic incentives and information. For many healthcare providers, patients and payers, the ultimate goal of innovation is creating lower-cost care options and increasing access to data that removes barriers to excellent care. Because of these unified goals, we’ll continue to see more health IT companies being created, experiencing growth and ultimately, achieving successful exits.

Once the pandemic ends, we’ll see a return to more in-person healthcare than we’re seeing today. However, the rapid and successful adoption of telemedicine in 2020 and stronger incentives for the healthcare industry to become more efficient and affordable will continue to drive demand for health IT startups to disrupt the old guard. We think that the best care models are likely to be hybrid models that incorporate in-person care, remote monitoring of data, and virtual care. We’re still facing obstacles of accessibility and outdated, clunky technology (fax machines, anyone?) that will drive demand for tech solutions to fix these ongoing challenges.

Aaron Martin, Executive Vice President and Chief Digital Officer, Providence; a HIMSS Collaborator

Aaron Martin, Executive Vice President and Chief Digital Officer, Providence; a HIMSS Collaborator

The Top Three Trends in Healthcare Investing

At Providence Ventures, our top three areas of focus center on what we call Distributed Care. Essentially, transitioning the care model from a primarily in-office model, to one where patients get care at the most appropriate venue of care, for their specific concern, at that particular point in time led by virtual care in every clinically appropriate care setting. With COVID-19 induced pressures toward value-based care, accelerated consumer acceptance and pressure for regulatory changes—the time is now for this industry disruption.

1. Virtual Care

Virtual care is undeniably hot right now with virtual ambulatory care expanding from 1-2% pre-COVID to 20-30% on an ongoing basis. Consumer willingness to use telehealth has increased to 66%, and most health systems believe as much as 40% of primary care visits could be handled via virtual visits—and some of the balance being delivered in-person including at the patient’s home. Investment in telemedicine solutions nearly tripled between 2019 and 2020, growing from $1.1 billion to $3.1 billion, with a doubling of the total number of deals.

The real opportunity, however, is moving the industry from Telehealth 1.0—essentially an island of video visits outside of the care continuum—to an integrated digital operating system that aggregates patient intent by matching care with search, navigating patients to the right venue of care, and optimizing access to care.

2. Remote Patient Monitoring

Remote patient monitoring is similarly trending. We’ve seen total funding for RPM solutions more than double from $417 million to $941 million in 2020. We’ve seen the power of RPM during COVID-19 at Providence. Our RPM solution that utilizes two of our portfolio companies—Xealth and Twistle—enabled a 1:100 nurse to patient ratio for COVID-19 patients, allowing us to scale access to patients across our geographic footprint—and the industry is seeing similarly scalable solutions in the chronic disease management space as well as other areas.

3. Digital Behavioral Health

Digital behavioral health also has incredible potential and the market demand for solutions is extremely high. We’ve seen funding for mental health solutions increase from $599 million to $1.4 billion in 2020. We’ve already invested in Lyra—which focuses on employer assistance programs in the employer benefits space and made it available to our caregivers who are under extraordinary stress caring for patients during COVID-19. We’re now looking at integrated clinical models to help us identify depression and anxiety in clinic, support suicidal patients in our emergency rooms, and provide scalable computerized cognitive behavior therapy and counseling solutions.

How Healthcare Investing Trends will Impact the Market in the Next Year

Because of COVID-19, the world changed and Medicare and Medicaid, as well as other insurers, loosened restrictions and payments for telehealth visits. This trend will likely continue for most of 2021. Although it started with one-off check-ins, 2021 will see a rise in the use and efficacy of virtual care services once thought to be “in-person only” including maternity, postpartum, pediatric and orthopedics. The use of telehealth in chronic disease management will also accelerate. Finally, specialty practices, in particular, are seeing successful and positive patient experiences due to telehealth visits.

RPM is similarly supported by the continued growth in reimbursement models, so we believe the use of RPM tools for chronic care management will continue to grow in 2021. As the migration to value-based care continues, we expect to see remote monitoring tools help expand physician access to patient data and enable preventative care models. As was proven by the rollout of COVID-19 related RPM solutions, access to longitudinal patient data can help with patient triage to downstream services and enable more proactive care, which could result in the higher consumption of downstream services.

Digital health tools/wearables will become important components in monitoring patients, providing support and tracking behaviors—right from home. The emergence of digital biomarkers has the potential to support remote diagnostics and further expand RPM use cases.

In terms of behavioral health, key stakeholders along the healthcare value chain—providers, payers, employers, to name a few—have recognized in the last five to 10 years that investing in behavioral health saves hard costs over time; however, competing and disjointed payment models have led to an array for administrative pain points in accessing behavioral healthcare (e.g., provider shortages, inadequate reimbursement, complex care navigation.) Ironically, COVID-19 has actually helped with this problem—bringing behavioral health further into the limelight and showing a clear need for serious behavioral health investment. We believe that as commercial payers follow market demand for behavioral health benefits and as providers move toward risk, that payment models will become increasingly favorable to behavioral health investment.

The Impact of COVID-19 on Healthcare Funding and the Lessons Learned

Overall, funding in digital health was driven higher by COVID-19. Total funding for digital health (including venture capital, debt, and public market financing) reached $21.6 billion in 2020, up 103% compared to $10.6 billion in 2019 venture capital funding specifically (including private equity and corporate venture capital) came to $14.8 billion across 637 deals. That represents an increase of 66% compared to $8.9 billion invested in 615 deals in 2019. Since 2010, digital health companies have received $59 billion in venture capital funding in over 5,000 deals.

In terms of lessons learned, we’re rethinking some of the most fundamental assumptions in terms of timing of change within health systems. Many investors, including Providence Ventures, took the onset of COVID-19 as an opportunity to reanalyze and reaffirm investment theses, illustrated by a three month “breather” from writing new checks. During this time the team dove deep to understand how the pandemic would impact various trends. Some early learnings:

- While COVID-19 upended the healthcare system and broader economy, it didn’t create many new trends in healthcare—it mainly accelerated existing trends.

- In particular, COVID-19 effectively funded the “trial and adoption” of digital health/telemedicine technology. Tens of millions of patients were forced by circumstance (lack of personal protective equipment, closed clinics) and safety to sample this new digital approach to healthcare and they liked it. This advantages disruptors because they don’t need to spend the marketing dollars to get patients into the market. Health systems and plans need to quickly make investments in digital or be left behind.

- For health systems, their business will bifurcate into a highly digital preferred provider organization/cash pay channel where digital convenience, price transparency, and access will matter most and a highly integrated payor/provider models. These changes are being driven by competition from disruptors and national payor/providers. This means there will be investments in digital platforms and payor/provider solutions.

- Market liquidity confirmed broader market interest and investor appetite—the M&A and more importantly IPO activity in 2020, including the subsequent market growth post IPO of many health IT companies, illustrates the growing public market interest in healthcare innovation.

While the COVID-19 crisis hurt the world in unimaginable ways, the pandemic also created a new desire to improve the healthcare system given the flaws in our largely fee for service model industry. This is only the beginning of larger changes in the industry. Health systems, which the American Hospital Association predicts are facing catastrophic financial challenges in light of the COVID-19 pandemic (estimating a total-four month loss of $202.6 billion), will likely accelerate their move into value based care models to help diversify revenue streams and protects against the downsides of fee-for-service models illustrated by the pandemic.

Indu Subaiya, MD, MBA, Co-Founder and President, Catalyst @ Health 2.0; Senior Advisor, HIMSS

Indu Subaiya, MD, MBA, Co-Founder and President, Catalyst @ Health 2.0; Senior Advisor, HIMSS

The Top Three Trends in Healthcare Investing

1. Different Modalities of Telemedicine

There’s no question that the increase in telemedicine and remote monitoring are some of the biggest trends coming out of the pandemic, but we have to get more granular than that and ask, “How can we deepen our understanding of the utilization of different modalities of telemedicine?” In what ways is video making sense, in what ways is the telephone making sense and what sub-groups of patients are we drawing in or leaving out with each approach. How are we extending telemedicine with add-on technologies that will enable an actual physical exam to be done virtually. We’re learning as we go about which modalities for which groups of patients work best and for which conditions. I’m also interested in the continuum of telemedicine into the home, with pharmacy at home, testing at home and more.

2. Testing and Tracking Technologies

The second category is testing and tracking technologies. Having to manage at scale distribution and testing for COVID-19, including genomic sequencing and the challenge of mass vaccination scheduling and administration have stimulated a burst of innovative solutions for triage and tracking large populations of patients and community members. Many of these platforms are either pivoting or expanding from their focus on other conditions and they’re providing infrastructure for future population-level tracking of health outcomes.

Big tech has a big role to play here—these organizations have the opportunity to provide information about health in a large-scale surveillance capacity, whether it’s to monitor social distancing using GPS, to looking at the location of outbreaks on a map, or trending of symptom reporting data through a phone. We’re going to have to face people’s concern about surveillance technologies as we transition to a better understanding of how individual health impacts public health and vice versa.

3. Mental Health Technologies

For number three, I would say mental health technologies. We are seeing a lot of investment in tracking, reporting and accessing care for mental health—it’s not just about consumers/patients, it’s also about our workforce. We’ve seen huge amounts of burnout, post-traumatic stress disorder—some of this is only coming to light now and I think we need technology now more than ever to bridge the gap. We’re seeing investments not just from the financial community, but from governments, health systems and the educational sector as we think about how to equip people to manage mental well-being.

How Healthcare Investing Trends will Impact the Market in the Next Year

We’re going to see more merger and acquisition activity—the best in class solutions may be adopted by a large platform player. And increasingly that could be a large digital health entity like an established telemedicine platform or an established digital therapeutics platform now that those types of technologies have gained such a foothold thanks to the pandemic. We’ll see new research and development coming directly out of big tech.

Health systems will have to start to think differently about their areas of responsibility and jurisdiction because with more of this public health lens, their “market” will not fall into the same type of boundaries that we typically think of. We have to think with a broader level than: Now we have to think about the community at large, or the city at large, or the state at large. These shifting boundaries for how you define a market will make things interesting for health plans and health systems. In an era of communicable disease, it’s not just about the member or patient, it’s their whole household, where they live, where they work. So that’s a big implication for markets.

And I think we’ll continue to grow as a sector—we saw record investment in 2020. Now these organizations are going to have to use that money in addition to benefiting from long overdue improvements in reimbursement for digital health. They’re going to acquire other companies, they’re going to make investments in infrastructure and they will customize for various subpopulations and conditions. The space will continue to expand in the coming year because every large stakeholder—from health systems to employers to health plans—are going to have to retool to stay in business and to grow their businesses and they’re going to need new supports to do that.

The Impact of COVID-19 on Healthcare Funding and the Lessons Learned

We’re shifting away from admissions volumes to optimizing care—triaging patients to the best modality of care, and understanding and advocating for reimbursement for digital health tools. We’re going to need a lot more creativity when it comes to public-private partnerships. When it comes to vaccines, it’s not just one vaccine company—we need everybody at the table. It’s this idea of competition to cooperation—the spectrum of competition and cooperation will blur in this new era because the government is not going to solve it alone, or the vaccine companies are not going to solve it alone. We’re going to need everybody working together.

And I think the same is true for digital health. We’re going to not necessarily be thinking of one winner, but an ecosystem of players that are each addressing different aspects of the health needs of a population. It’s going to be a great time for interesting partnerships and value creation through new reimbursement models and new modalities that have become entrenched in the pandemic and can now be leveraged. The kids gaming console—maybe now we begin to really consider games for health. Can we take advantage of that?

Healthcare Investing and Health Equity

A lot of needed attention has been raised around health disparities, diversity, inclusion and health equity, and many large health systems have made big investments in health equity this past year. This is going to impact digital health because we have huge issues around the digital divide, around disproportionate use of telemedicine, differences in COVID-19 rates, vaccine adoption, testing access—all of these disparities have been highlighted. And from an investment perspective, investing in technologies that are going to help us get to everybody, to level the playing field, that’s going to be more important than ever. And ways that we can target the most vulnerable groups and know how to go about reaching the most vulnerable groups, that is going to be incredibly useful.

We talked earlier about testing and tracking technologies—how do you know what order to go when you have a huge population to treat? You need data, decision-support tools, tracking tools, and you need to know something about the patient. So this idea of health equity addressing disparities in health, that’s going to be a stimulus for the kinds of technologies and the data platforms we need to better address subgroups of patients and consumers based on their vulnerabilities.

The views and opinions expressed in this content or by commenters are those of the author and do not necessarily reflect the official policy or position of HIMSS or its affiliates.